Day trading gold

Before getting into the specifics of intraday trading, let me explain the difference between a full lot in currency pairs trading and a full lot of XAU/USD. Understanding forex broker tick cost calculation will help calculate your potential earnings for one day based on the average length of a daily candle.

How much is 1 pip of gold worth?

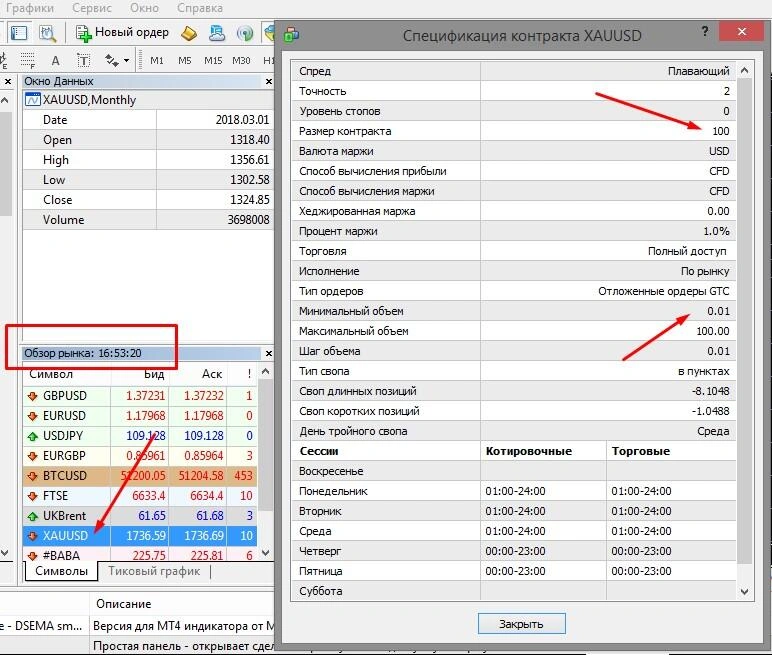

The price of gold on Forex in trading platform quotes or analytical charts is the price per troy ounce. 1 troy ounce is equal to 31.1 grams. 1 standard lot is 100 troy ounces, the minimum volume of a Forex trade is 0.01 lots. All these data you can see in the contract specification, which in MT4 can be found as follows:

Select “View – Symbols” in the menu. Find the XAU/USD pair and click “Show”.

Select “View – Market Watch” in the menu. Right-click on the XAU/USD pair and select “Specification”.

How to calculate the value of a pip (point) on gold on Forex:

In the specification, we find the contract size – 100.

Define the dimension of a pip (point). Gold quotes in the platform have two decimal places – unlike currency pairs, a pip is equal to 0.01.

Multiply the volume of the trade by the point dimension: 100*0.01 = 1 USD.

The minimum price fluctuation of the XAU/USD pair by 1 pip (point) corresponds to 1 USD. In other words, if you buy 1 troy ounce for 1800 USD, it corresponds to a transaction volume of 0.01 lots. And a price movement to 1805.35 USD would mean a price move of 535 pips. For 0.01 lot the pip value is 1/100 = 1 cent – earnings will be 5.35 USD. Accordingly, for 1 full lot the earnings are 535 USD.

Now let’s return to the comparison of XAU/USD profitability with currency pairs intraday. The cost of a point on EUR/USD = 100,000 * 0.00001 (five-digit quotes) – also 1 USD. The average length of one XAU/USD candlestick in a calm market is 1000-1500 pips (pips). The average length of a EUR/USD daily candle is 800-1000 pips. But we should not forget about the spread – XAU/USD it is bigger.

From this we can draw conclusions:

Intraday volatility of XAU/USD is relatively similar to currency pairs – if markets are calm and there are no strong fundamentals.

XAU/USD has low volatility on minute intervals, so it is not suitable for scalping. But it has a more stable trend with fewer intraday reversals.

Day trading gold on H1-H4 intervals can bring profit only at the level of currency pairs. But XAU/USD is sensitive to fundamental factors – the daily movement can expand up to 2500-3000 pips and in the opposite direction to your position.

Tips for opening XAU/USD trades:

- Open trades only in the direction of the trend, preferably at the beginning of a daily candle. If on the daily chart there is movement in 2-3 candles of the same color – on the hourly chart you can catch trend movement.

- Catch the fundamental movement, do not close trades on local corrections.

- Pay attention to quotations of related assets – silver, platinum. With their help and, for example, the gold silver ratio, you can build trading strategies for gold based on direct correlation. Au also has a direct correlation with oil quotations and an inverse correlation with USD.