Trading Signals for gold

Make trading decisions on gold based on Trade Signals. Each buy or sell signal has two main indicators – profitability and probability – to make informed decisions.

If you want to receive valuable signals on gold? Then you should contact us!

Trading in commodities and precious metals is now possible with the help of brokerage companies. You can make money on your own, using your own trading strategies, or you can use trading signals offered by experienced traders.

Trading Signals

- 2000+ PIPS guaranteed monthly

- 3-5 VIP signals are set daily

- 98% weekly accuracy on signals

Advantages of trading on signals

Saving time

Receiving signals from analysts saves time, freeing traders from basic market analysis.

Education and experience

Trading on signals is a great opportunity to learn and gain experience by following the signals of experienced participants.

Efficiency

A systematic approach to trading signals improves efficiency through data analysis, reducing emotional impact.

Try the trading signals

How does it work?

Statistics

Get trading signals

- Trading signals are based on a thorough analysis of market data and technical indicators by experts

- Get recommendations on entry and exit points, stop loss and take profit levels.

- Use signals to make informed decisions, minimizing the influence of emotions in trading.

What should you consider when trading on gold signals?

- How do trading signals work?

- How to use trading signals?

- How to manage risks using trading signals?

What are trading signals, and how do they work?

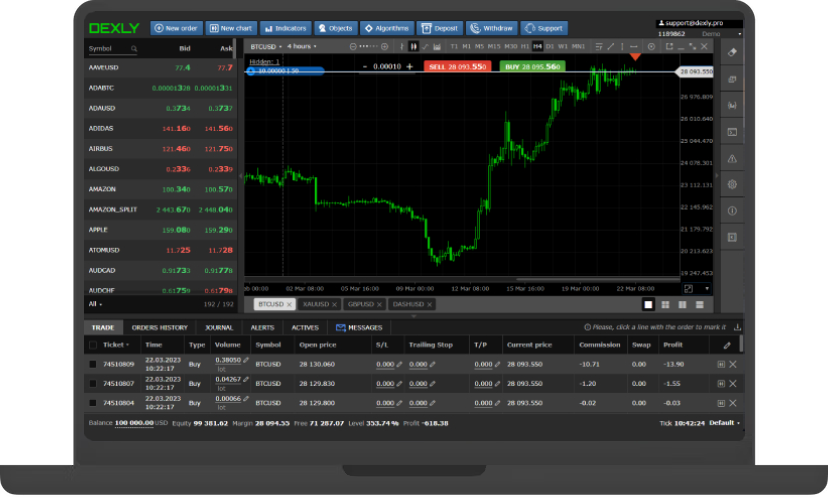

Trading signals are provided in the form of written messages by experienced traders or specialized companies free of charge or for a fee.

A signal is usually a very short message containing only the main elements, and looks like this:

XAUUSD SELL 2033 – 2036

SL- 2038

TP1- 2030

TP2- 2028

TP3- 2026

What are Buy and Sell?

There are two types of transactions for trading on the Forex market: buy (buy) and sell (sell), as well as protective orders. Let’s take a closer look at them.

A Buy order is a transaction when a trader expects that an asset, for example, a currency pair, will grow in price in the future, i.e. become more expensive.

When opening a Sell order (Sell order), a trader assumes that the chosen currency pair will decrease in price

What are stop loss and take profit?

Stop Loss and Take Profit – are types of protective orders that are placed to automatically close a trade. Stop loss limits possible losses of a trader, while take profit helps to fix the profit when it reaches the desired level.

The main task of such orders is to control trading in the trader’s absence. For example, if a user cannot be at the computer all the time, or if he/she opens orders for the long term, such functions are useful and even irreplaceable. After all, in the absence of a trader, the market can turn sharply and go in the opposite direction, and in a short period of time, a profitable trade will become a loss. A stop loss will help to minimize losses in such a situation. The opposite is also true: if at some point a strong movement brings a trade to a good profit, a take profit will help to fix it before a pullback occurs.

Signals of the stock market help novice traders to get accurate information about trades recommended by signal providers Forex in real time. However, be careful, these signals are not infallible.

There are many providers of signals on the market. Therefore, it can be difficult to understand which of them is really reliable and gives profitable Forex signals. We’ll help you figure it out.

Free and paid Forex signals

The price of signals will vary depending on who provides the service. Some brokers offer free signals Forex. While other providers may provide signals at a price of $5 to $10 per day.

If you need long-term access, there are options with a one-time fee for a subscription to a service package. Most often, the payment ranges from $50 to $100, but it can also go up to several thousand dollars.

Remember that you should only trade using signals provided for free if you are fully confident in the reliability of the signal provider. Also, do not trust a signal provider that does not have a live trading account. Trading history is the best indicator of success. If there is no trading history, do not buy the signal. If the provider can only demonstrate the history on a demo account, it usually means that they do not believe in the effectiveness of their signals in a real trading environment.